A brilliant idea is not a startup yet. An idea itself doesn’t work: it exists only in your head. A startup begins when you bring this idea to life. Unfortunately, it’s impossible to do without funding. In this guide, we’ll go into the issue of startup investing and share some ideas of where and how one can look for investors.

Types of Startup Investors

Before making any real steps, study the theoretical part of the question. One thing you need to decide on is the type of investors you want to attract to your startup. Basically, there are four common types of them.

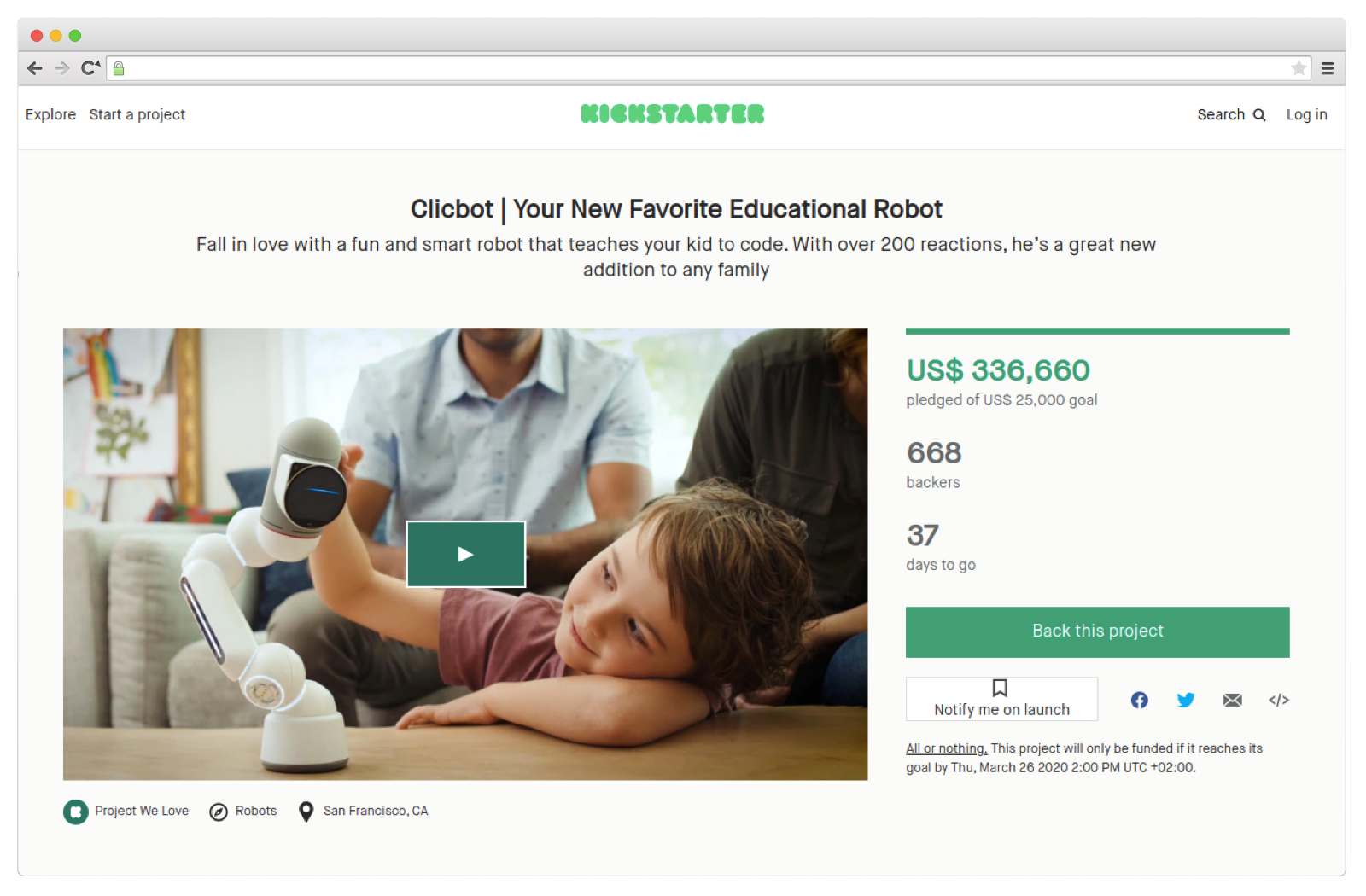

Crowdfunding

As the name implies, the project is funded by a “crowd,” i.e., by a large group of people within this approach. Each participant adds a small fraction of the total sum until the required amount is collected. This method works for small and medium-sized startups. There are some dedicated online platforms to look for potential investors – Crowdfunder, Kickstarter, GoFundMe, and others.

“Angels”

The so-called “angels” are people who are ready to invest in risky but promising startups with potentially high ROI. From the very beginning, angel investors consider the possibility of losing their money (if the project fails), so they invest quite moderately – from $25 000 to (rarely) $100 000. You may try looking for “angels” on your own at various themed conferences or on special platforms, such as Angellist or Angel Capital Association.

Venture Investors

Venture capitalists are large companies (not individuals) that provide funds to large, serious projects. They rarely invest in new startups at the initial stage of their development. Instead, they opt for working projects that have the potential to grow. Also, they would expect to get a share in the company. If you are still in the stage of prototype development, you’ll hardly find a venture investor unless your project is really unique and very promising. But you may try your luck, for example, at Venture Capital Association.

Business Incubators

If you failed to find direct investors, try to address a business incubator – there are both online and offline options. These organizations support startupers in several ways: apart from providing funds for the project development, they conduct lectures, help you meet well-known business people, and even help find venture investors. However, the competition is relatively high, so you must be very convincing to succeed, and your project must be thought-out perfectly. One of the best-known BI companies is National Business Incubation Association.

How to Get Prepared for Meeting Investors

No matter what startup funding strategy you choose, you need to keep in mind that all investors have many offers to choose from. No wonder all of them want to work with the best startups. To succeed in fundraising, you must come up huge. Apart from the project itself, there are more things to consider.

Establish Business Ties

Money is important, but well-established business relationships are almost equally important. So before looking for investors, try to find experts in your sphere. Not only can they give you important advice and recommendations, but they also may want to join you at some stage. It will add weight to your startup and help raise funds.

A prototype is a Must

You must know that a picture is worth 1000 words. You may sound very convincing, explaining how your wonderful product will function, but most investors would prefer to see it, not just here. This is especially true for all types of IT products. The best approach is to create a prototype, attracting professional designers if needed. Alternatively, you may use one of the ready-made tools for prototype creation, such as Sketch, InVision, or others.

Make a Presentation

Prepare a demonstrative pitch deck to show in pictures what your startup is about, your close competitors, and your commercial advantages. You may use PowerPoint or any other similar tools. Below, you can see a presentation made by Uber as an example.

If you are looking for investors on a crowdfunding platform, make a short video to show the main aspects of your startup and answer key questions:

- What’s the main idea?

- At what stage are you now?

- Why do you need money? How much?

- What are the benefits for investors?

- What if you fail?

Don’t make your video too long. Potential investors can ask for details later if they want.

Common Mistakes to Avoid

Unfortunately, many startupers fail to find investors, despite having brilliant ideas and a well-made tech startup business plan. The reasons can be different, so you can hardly foresee everything. But, at least, you can avoid common mistakes that keep investors away in most cases.

1. An overused idea. Nobody is interested in another copy of Facebook or TikTok. Be creative.

2. You are the only founder. It looks quite questionable and scares away potential investors.

3. Lack of flexibility. Be ready for sound criticism and modify the idea and goals if needed.

4. A weak technical part. Make sure to hire a web developer team with a due level of experience.

Summing Up

If you’ve made up your mind to find investors, you need to arm yourself with patience. The process can require a lot of time and effort. Don’t give up if you fail once; analyze your mistakes and try again.